Some freelancers throw around posts about being FIRED to making 165,036.20 in 8 months. These posts might be exciting (it’s my top post by far) but what about expenses and what does overall profitability look like?

This post will give you an inside look at my total operating expenses for last year (2021). My experience to date has shown that overall expenses are low, roughly 10-20% of revenue in any given year.

Your expenses will likely be different but you can use the data below to gauge your own expenses if the “cost of freelancing” is a barrier to you starting.

Let’s jump right in!

Breaking Down $42,760.18 in Freelance Expenses

A final note before we jump in. I did not include federal/state taxes as “expenses” in this write-up. We can assume everyone pays taxes regardless of W2 or 1099 contractor status.

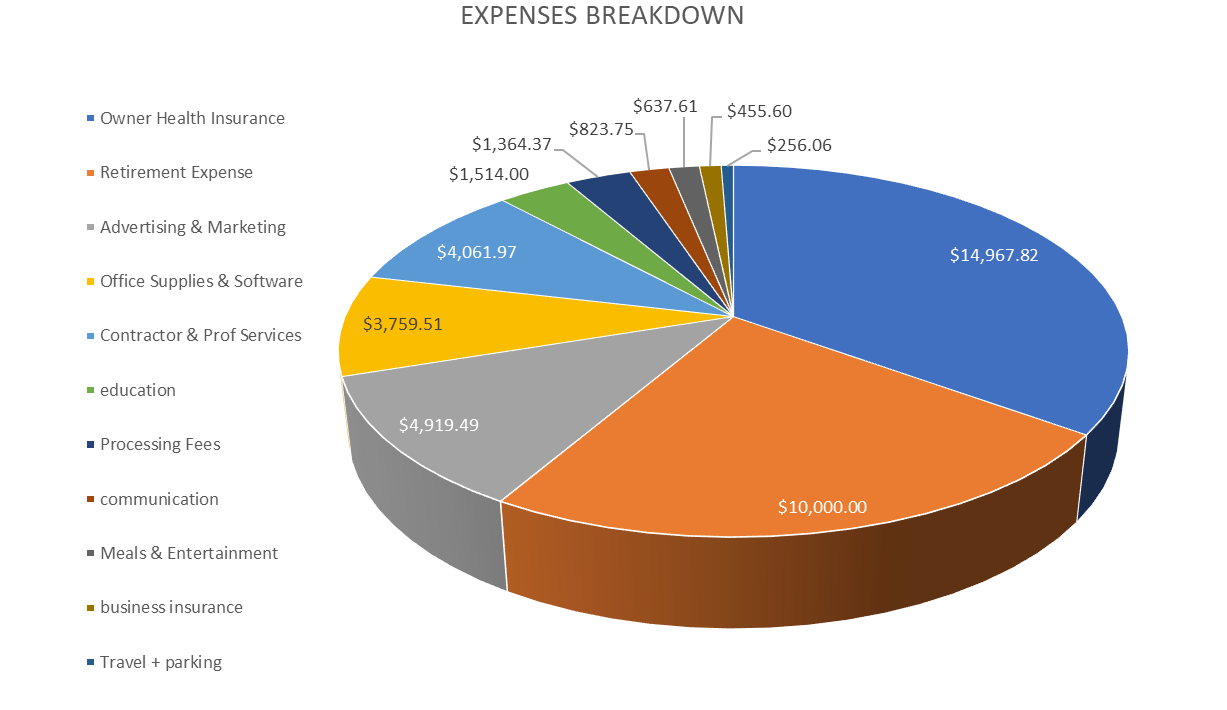

The graph above shows you how my $42,760.18 in expenses is broken up. The rest of these articles will be going deeper into each bucket of expenses and how yours may be more or less depending on how you operate.

Health & Dental Insurance – 35%

I provide health insurance for my family of five. It’s by far the biggest expense that I accrue as a freelance consultant. The good news? Health and Dental Insurance is a deductible expense* assuming you don’t have the means to acquire insurance through an employer. I write in much more detail about health insurance for freelancers in this post here.

If you freelance part-time or your spouse has medical benefits through their employer, then you may be able to avoid this expense altogether. As you can see above, this can save you a big chunk of change, making a freelance career even more profitable.

*note that while medical premiums are deductible expenses for your business, what you pay out of pocket for co-pays or co-insurance is not a business deductible.

Retirement Contributions – 23%

When you make the decision to forgo working for someone else, you also forgo the benefit of a retirement plan with a potential employer match. This means that if saving for retirement is a priority then you will need to fund it on your own.

Again, one of the benefits of working for yourself is that you can write off employer-made retirement contributions. In this instance, Nick LeRoy Consulting paid into (employee) Nick LeRoy’s SEP-IRA account $10,000.00*.

You can learn more about SEP plan limits here but for my purposes, my company can contribute up to 25% of my salary**.

Do not take this post as tax accounting advice. I utilize an accountant to help me and I highly recommend you do such as well.

* My total SEP-IRA contribution will be higher but the exact number is unknown at this point until we get closer to filing taxes. Retirement contributions for 2021 are not limited by the calendar year limits.

** As an S-Corp salary is defined at one number and anything beyond that number can be withdrawn as an owner’s draw not subject to various self-employment taxes.

Advertising/Marketing – 12%

Website hosting, domain registration, paid advertisements (PPC/paid-social), newsletters, swag… this is all a business expense.

Most of my expenses in this category come from the following:

- Website hosting

- Email hosting/cloud storage

- Domain registration

- Email/Newsletter distribution costs

A lot of these expenses are tied to the SEOForLunch and TheSEOFreelancer newsletters in addition to the affiliate sites I run. If you are strictly running a services-based freelancing business you may also be able to cut this expense down.

Contractor/Professional Services – 10%

I don’t regularly use SEO contracts with my own work. The one exception was for a friend of mine who recently went out on his own providing SEO freelance services. To give him a leg up on his freelancing journey I had him help me with an SEO audit deliverable. He absolutely crushed it.

The services I do contract out are my accounting/bookkeeping and development/design. The latter is typically associated with a newsletter or affiliate site which I’ll cover in an upcoming post.

Office Supplies & Software – 9%

This is an area of cost that will vary considerably from freelancer to freelancer.

Expenses that fall into this category for me:

- Crawling tools: Screaming Frog + SiteBulb.

- KW research + Link analysis: Ahrefs + SEMRush.

- KW tracking, auditing + real-time monitoring: ContentKing, RankRanger + SERanking.

- Content Briefs: Content Harmony

- Time Tracking: Harvest

- Accounting Software: Quickbooks

- Proposal Software: Proposify

- Cloud Storage: OneDrive

- Misc: Printer paper, ink, mouse/keyboard, microphone, and other office-related expenses that add up but I couldn’t possibly list each one individually.

My expenses in this category are really low this year. Last year, in my first year of full-time freelancing I purchased laptops/monitors, standing desks, and some of the more expensive items. If you are new to freelancing you may need to budget some additional funds to cover these startup costs.

Education – 4%

With COVID-19 the ability to go to SEO related events was extremely limited. This past year I paid for the following educational resources:

- Traffic Think Tank (slack mastermind)

- MNSearch MNSummit (in 2022)

- Books – Company of One, The Subtle Art of Not Giving a F*ck, product-led SEO

If COVID allows, this is an area (along with travel) that I expect to increase in 2022+.

Bank & Processing Fees – 3%

I highly encourage that you accept ACH (direct deposit) and credit card payments for your client invoices. Paper checks add time and layers of complexity to getting paid. Unfortunately, the downfall to using online payments is the various fees that go along with it.

These expenses came from Quickbooks processing ACH/CC payments in addition to a few international wires that my bank loves to charge me $15.00 a pop to process.

As you can see, these fees add up but in my mind are an expense I’m happy to pay to ensure payments are collected regularly and in a timely fashion.

Communication – 2%

One benefit of owning your own business is the ability to write off SOME of the expenses you may have normally accrued. For me, this includes my cell phone. I easily use my phone 80% for business.

This expense is the portion of my annual cell phone bill that I deem a business need. Note that you cannot count all your lines/plans as a business expense unless it is used for your business. In my case, I pay for 3 other lines as a non-business expense.

Meals & Entertainment* – 1%

COVID-19 made client meetings and networking a rarity. However, after immunizations were made available and with people I trust, I started meeting folks for coffee/beer/meals.

When you conduct business over a meal you can write it off as a business expense. In 2020 the IRS is allowing businesses to write off 100% of meal expenses whereas prior to COVID-19 it was only 50%.

This is another area I am anticipating an increase in expenses as COVID allows.

*note that entertainment is no longer applicable as a business expense. My tax software combines both. I do not use company funds to pay for any client/networking entertainment expenses.

Business Insurance – 1%

Up until this year, I did not have business insurance. I figured I didn’t need it. It wasn’t until I was having a virtual hangout with a few other freelance SEOs that I heard a few horror stories.

After that call, I started researching various business insurance. After talking to a few other freelancers I picked up a professional liability (errors and omissions insurance) policy. If you are familiar with this you can read more on their website.

I consider this a defensive expense. Taking precautions for any legal events that could potentially occur. *knock on wood*

Travel + Parking – 1%

In 2021 my travel was very minimal, again, due to COVID-19. I had taken one flight back in November to Arizona to visit a client which they covered most of the expenses.

This expense category was mostly used for parking fees and one hotel stay. Again, COVID allowing, I anticipate this cost to be higher in 2022+.

Freelancing Can Absolutely Be Profitable

Similar to sharing some of my income from previous years, this post is not meant to be any type of flex. It’s my attempt at total transparency to help you with your freelancing journey.

Everyone’s expenses will be different. I highly recommend that you also consult an accountant. A good accountant will add to your expenses but they’ll easily save you more money in the long run than you’ll ever pay them.

Let me know if the comments what your biggest expenses were in 2021. I hope everyone has a fantastic 2022 and make sure to CRUSH IT!