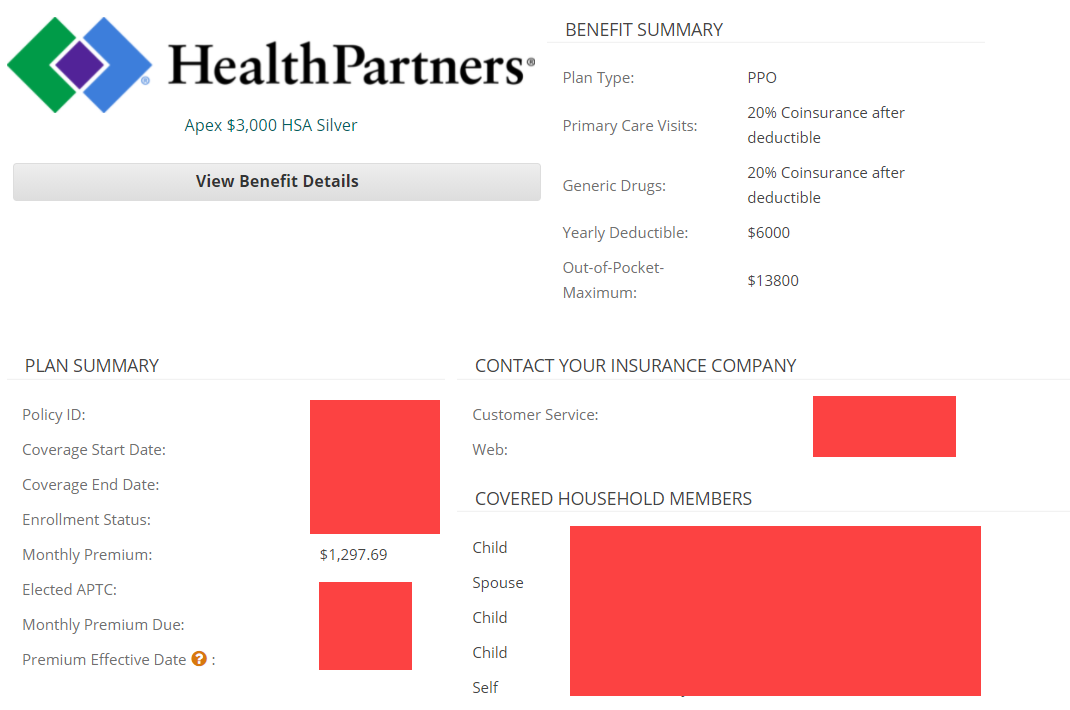

I pay $1,433.19 each month for my family of five’s health and dental insurance. That’s $17,198.28 per year in just premiums. Ouch.

This doesn’t even include out-of-pocket costs such as a deductible, which for me is an additional $6,000.00. Double-Ouch.

The US Health System Is A Broken System

Sixty-two percent of bankruptcies were caused by medical issues according to this report. I spent my entire career prioritizing job opportunities based on the health insurance plans that were available to me.

My family of five requires a fair amount of medical visits each year in addition to prescriptions. This single “benefit” prevented me from going out on my own out of fear. I was terrified about high premiums, outrageous deductibles, and other out-of-pocket expenses.

No doubt health insurance is expensive but it does not have to be a deal-breaker for those looking to go freelance full-time.

The Easiest Solution Isn’t An Option For All

Are you married? Does your significant other qualify for health insurance through their employer? The easiest (and typically cheapest) solution is to get added to their health insurance.

With three children, my wife works part-time as a Registered Nurse which does not qualify her for benefits. It was important to us to maintain the flexibility that her schedule affords us so that left us with only one option… private healthcare insurance.

Insurance Isn’t As Scary As You Might Think

I can only speak to my experience buying insurance in the state of Minnesota. Your experience will likely differ but shouldn’t be too different. I recommend checking out healthcare.gov for more details on coverage in your area.

In Minnesota, we have a program called MNSure that allows Minnesotans to compare various private insurance options and if you qualify, receive discounts on your premiums.

I was able to compare all the plans side-by-side and even sign up directly for my new healthcare and dental coverage all online.

What Determines Health Insurance Costs?

As previously mentioned, my family has various medical needs which makes the level of coverage we require a bit more expensive. If you are single and relatively healthy you might find that your insurance is significantly less than what I pay.

When reviewing various health insurance coverages you will have several variables that play a direct role in the cost of your coverage.

- Your age

- Your location

- Who’s on the policy

- Tobacco use

- Health insurance plan (bronze, silver, gold, platinum etc*.)

* Each of these options have a different cost associated with them. Typically, bronze being the cheapest with the least amount of flexibility in coverage up to platinum and the most flexibility.

What To Consider With Your Insurance Coverage?

Below are a few additional things to consider when determining what level of health insurance is best for you.

Copays and Deductible

Typically, the less you pay out of pocket for your medical services the higher your premium will be. If you are fairly healthy you may opt for a high copay and deductible with the notion that you will only use your insurance in an emergency situation.

Network Coverage

Insurance companies established agreements with health providers and these are the providers that you will need to use. Typically, the higher the plan the larger (and broader) the network.

If you have doctors you already see then you’ll want to make sure that they are considered “in-network.”

Prescription Coverage

Each insurance plan will clearly state how they will cover prescription drugs. If you don’t require regular medication this is an area that could save you money. A member of my family requires a $700.00/month medication so for my family prescription coverage is essential.

PPO or HMO

This is an area that gets complicated quickly. With each insurance plan you have different networks you can access. Health Management Organizations (HMO) tend to be the cheapest but you are forced to use their network of doctors exclusively. You will receive no coverage if you see a medical provider outside of that network.

Preferred Provider Organization (PPO) has a network of coverage similar to HMO but you also have an option of seeing “out of network” providers at a higher price but less than having no coverage.

Insurance Is Expensive But Is Also A Tax Write off

Most employers pay anywhere from 50%-100% of your healthcare insurance premiums. You can see how this is a fantastic benefit but if you freelance you get one nice benefit.. you can write off 100% of your premiums.

I started this post by stating I pay $17,198.28 per year in premiums. I write off 100% of this cost as a business tax deduction.

It’s important to remember that a tax deduction is not “free” money but it allows you to pay taxes on a lower income. I won’t go into all the details of tax credits vs tax deductions, you canread more about this here.

Don’t Forget About Other Tax Incentives

Another benefit if you select a high deductible health insurance plan is the ability to use a Health Savings Account.

This is money you can add to a “savings account” used exclusively for medical bills and is tax free. For individuals you can contribute $3,650 and families $7,300.

This is not a business expense but will help you further lower your taxable income at the end of the year. This benefit is not limited to the self-employed.

Freelancing Benefits Outweigh Insurance Costs

When I worked 9-5 I paid $550.00 per month for very similar insurance coverage for my family. So I pay a little more than $10,000 more each year for the following benefits:

- I made 50% more than my last salary in only 8 months.

- The hours I work has reduced by 25%

- Full control of my growth which was one of my goals in going freelance.

Health insurance was my biggest fear and prevented me from going freelance full-time for years. Is it expensive, yes! It is worth it, yes X100!