Confession Time

In my recent freelancing goals post, I talked about replacing your salary with a simple math equation.

Take your annual salary and divide it by 2080 hours (40 hours X 52 weeks).

As a freelancer, any rate you can charge above this number results in more money or time (hours) you can use as you wish. Sounds better than a traditional 40 hours 9-5 role, right?

This is wrong… and was intentional.

I didn’t fool any of you and it didn’t take long to get emails such as the one below. My simplified calculations didn’t take into account one MAJOR factor.

Employee Benefits.

Holy Benefits Batman

Employee benefits are one of the most taken-for-granted components of working for someone else.

When I say benefits I’m talking about healthcare, dental, 401K, paid time off, sick leave, stock options, and even food/drinks.

Many of the above aren’t easily quantified in dollars so people don’t always place them into consideration when going freelance full-time.

Let me tell you a freelancing secret…

YOU GET NONE OF THESE GOING OUT ON YOUR OWN AND THEY ALL HAVE VALUE.

Stop Yelling, We Get It, Benefits = Good.

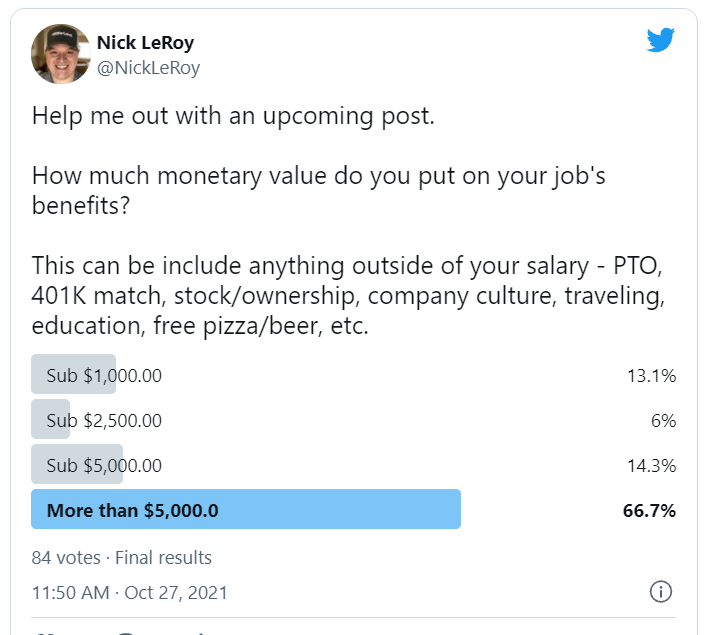

I polled my Twitter followers (make sure to follow me) and with 80+ responses, the vast majority of responders placed a value over $5,000.00 for their current benefits.

Let’s assume a $70,000 SEO role. Below is a hypothetical value for a few of the most common benefits.

- 50% of FICA taxes (3.1% * 70,000) = $2,170.00

- Health Insurance = $3,300.00*

- Dental Insurance = $180.00**

- Retirement Match (3%) $70,000*0.03 = $2,100.00

- Paid Time Off (assume 3 weeks) = 15 work days (120 hours)

- Paid Holiday Time Off = 12 days (96 hours)

- Paid Sick Time Off = 7 days*** (56 hours)

These are some of the more common benefits. Parental leave, bonuses, company stock, life insurance, and educational assistance are additional examples that aren’t accounted for but would only increase the value in an individual’s benefits.

*based on an individual bronze plan monthly premium

**based on an individual low PPO monthly premium

*** average private industry days based on at least 1 year of employment

$7K+ 272 Hours Paid Time Off

Let’s jump back into valuing benefits using our hypothetical $70,000.00 SEO position.

$70,000.00 / 2080 hours is an equivalent hourly rate of $33.65

272 hours you won’t be working multiplied by your hourly rate ($33.65) = $9,152.80

Add the $7K of FICA, insurance, and retirement match and the true value of your benefits are closer to …

$16,902.80

The Real Cost Of Going Freelance

The equation of giving up benefits isn’t an exact science. We all value our benefits differently. The purpose of this post is to help establish a better apples-to-apples comparison when making the decision to leap into full-time freelancing.

We can, at minimum, agree that the break-even point is closer to $77,000 for the individual earning a $70K salary plus benefits.

The higher the position (and salary) the higher the value of their benefits will be. You can see how bonuses, stock options and other benefits typically reserved for higher earners make the equation even more difficult.

Let’s also not forget that a 9-5 employee gets paid for all 40 hours regardless of productivity. Freelancers get paid for projects and or hours billed.

This can serve as a double-edged sword which we’ll cover in a future post as getting this right is truly the difference between succeeding or failing as a freelancer. #coming soon.

Don’t Worry, I’m Still Very Team #Freelance

I recently had dinner with a friend who owns his own agency. He admitted that his feelings about this newsletter were conflicted.

“You make it seem that freelancing is easy and a no brainer. I don’t agree.”

I’m still very pro freelancing. However, I think transparency works both ways and my friend reminded me that in this newsletter’s infancy I’m skewing heavily towards the good parts of going freelance full-time.

Yes, I made 57% more than my old salary in my first 8 months of freelancing but I also paid $17,198.21 in health insurance premiums last year too.

It’s important to truly balance the benefits with the deterrents of this adventure. Determining the true cost to replace your 9-5 salary (and benefits) is just step one.

I hope this post portrays a better way to compare the two and determine which is the best option for you.

Until next time, keep crushing!