There isn’t a single affiliate link in this post. While the credit card affiliate game is very lucrative the focus is on getting you and your team (maybe even your family) free or greatly reduced travel.

What Are Credit Card Points?

There are many reasons why I believe you should be using credit cards for all your SEO/digital expenses. For one, most credit cards offer a layer of protection that you don’t get from a debit card. Imagine having to wait several weeks to get your money back in your bank account while having to account for regular expenses and even payroll. The second value which we’ll cover today is credit card points.

Most credit cards have a reward system. You may get a certain percent of your spend back (cash rewards) or you can get “points” that you can redeem for various rewards. There are credit cards that offer no rewards, I recommend you avoid these cards assuming you’ll be paying your cards off each month in full. If you don’t pay your balance off each month in full please read this before moving on with this post.

Why Care About Points?

Credit card points are often redeemed for free or reduced price airfare and hotel stays. It’s not uncommon to get a great deal as point values fluctuate from 1 to multiple cents per point depending on the time you claim them. I’ve gotten $3XX Delta flights for under 20,000 points. I’ve also gotten rooms that go for $400+ per night for great pointage values. The point being, you’re going to accrue various marketing expenses throughout the year. Why not leverage these expenses to get free flights or hotel stays?

Maximizing Your PPC/Social, TV & Radio Spend

Are you spending thousands, tens of thousands (or more!) on your media advertising? The American Express Business Gold Card offers 4 membership rewards (MR) points for every dollar you spend (on online, TV or Radio) spend up to $150,000.00. If you spend the total amount, you would amass 600,000 MR points.

If you claim these 600,000 points for a statement credit (1 cent/point) that’s $6,000.00 off your statement.

While you can also book flights/hotels directly through American Express, they also allow you to transfer points directly to select partners. You can see a few partners and transfer values below. (transfer partner:point to point transfer ratio)

Airfare

- Air Canada 1:1

- British Airways 1:1

- Delta 1:1

- JetBlue 250:200

- Virgin Atlantic 1:1

Hotel

- Choice Hotels 1:1

- Hilton 1:2

- Marriott 1:1

Maximizing Your Food, Gas, and Transportation Costs

How much money are you spending on filling up your car each month? Same with those office snacks? There is yet another opportunity to maximize your return on these recurring expenses. This time, the opportunity is straight cashback, not credit card points. American Express has a credit card called the Blue Cash Preferred. It offers the following rewards.

- 6% cash back at Supermarkets ($6k spend max)

- 3% cash back on gas, rideshare, bus, taxi, tolls, subway (no maximum)

6% back on $6k is $360.00. Assume you spend $10K on gas and transportation and that’s another $300.00. That’s $500+ dollars cash back for money your already spending.

Maximizing Your Office Supply Expenses (cable/internet too!)

How often are you buying paper, printer ink, pens, staplers, sticky notes and more? The Chase Ink Plus allows you to get 5 points per dollar spent at office supply stores. This 5/1 return is good for up to $50,000 spent each year. That’s 250,000 Chase “Ultimate Reward” points that you receive for the money you already spend keeping your office fully stocked.

Don’t spend $50K in office supplies each year? Don’t worry, you can pay your cable/internet bills for the office and still receive the 5 points per $1.00 (Up to the $50K maximum).

250,000 Ultimate Reward points are worth a $2500 statement credit or potentially significantly more if you leverage one of their transfer partners. (transfer partner:point to point transfer ratio)

Airfare

- Emirates 1:1

- JetBlue 1:1

- Southwest 1:1

- United 1:1

- Virgin Atlantic 1:1

Hotel

- Hyatt 1:1

- IHG 1:1

- Marriott 1:1

Success Stories: Leveraging Credit Card Points

Leveraging credit cards for my digital marketing expenses have afforded me several experiences that I otherwise wouldn’t have been able to afford.

Those who are signed up for the #SEOForLunch newsletter heard about me taking my family of 5 (plus my in-laws) to Hawaii just a few months back. The flight for 7 tickets was about $7,000. Damn! That doesn’t even cover lodging, food/drink or experiences.

I was able to leverage my American Express MR points by transferring them to Delta. In the end, I received 4 flights for about 180,000 points and only paid for 3 tickets out of pocket. That was a savings of $4,000.00. All these points came from various business expenses that I had to pay.

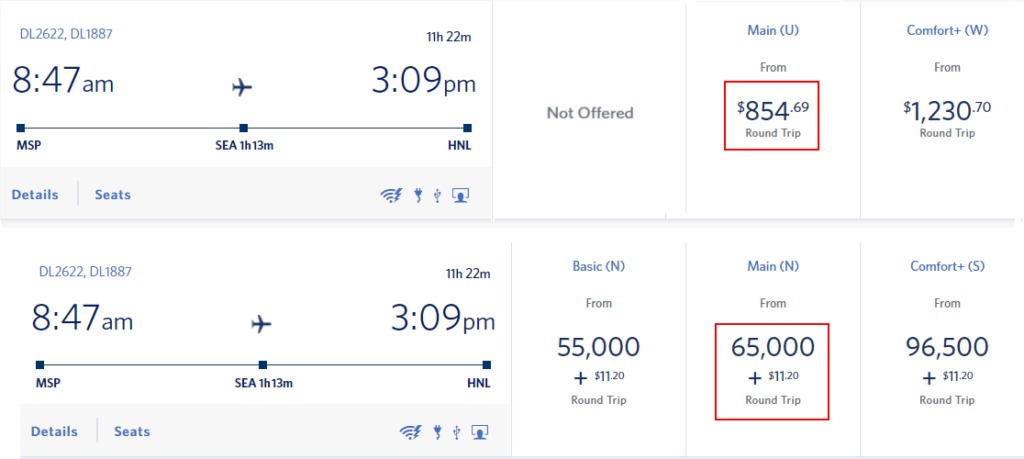

Below is an example if I were to book the same flight for this upcoming year.

Booking this flight would allow for a 1.3 cent value per point. Not the best but certainly better than ponying up $854.69!

Warning: Finance Charges (INTEREST) Wipe Out Credit Card Benefits

I can’t in good conscious publish this post without covering the risk of this strategy. Credit cards can allow for some amazing benefits but they are all wiped out instantly if you carry a balance on your credit cards.

Annual Percentage Rates (APRs) are typically 15%+ on all of these cards. If you regularly keep a balance on your credit cards then I encourage you to avoid the credit cards I listed above. These benefits will cost you far more in the recurring interest you pay then if you paid for them in cash.

Credit cards will provide great reward value only if you pay your balance off in full each month. Rewards are available to us all because credit card companies rely on making their money back by charging interest on those accounts that maintain a balance.

Additional Resources For Maximizing Credit Card Rewards

This post serves as an introduction to credit card rewards. It can allow you to get a little extra back for the money most of us are already spending in the digital marketing industry.

While all of the above tips can be leveraged with your personal finances, there are so many more strategies, tips, and “hacks” to maximize credit card rewards. Sound like something you’re interested in? Below are a few resources that you might enjoy.

Please be aware that while this post does not include affiliate offers, most of the resources below utilize them heavily. I am not affiliated with them in any way.